GLOBAL MARKET - NEW YORK/LONDON. Treasury yields mostly rose and a gauge of global equities slid from two-year highs on Tuesday after strong U.S. labor market data and as investors awaited earnings from the megacap stars that they fear could miss forecasts and drag the market lower.

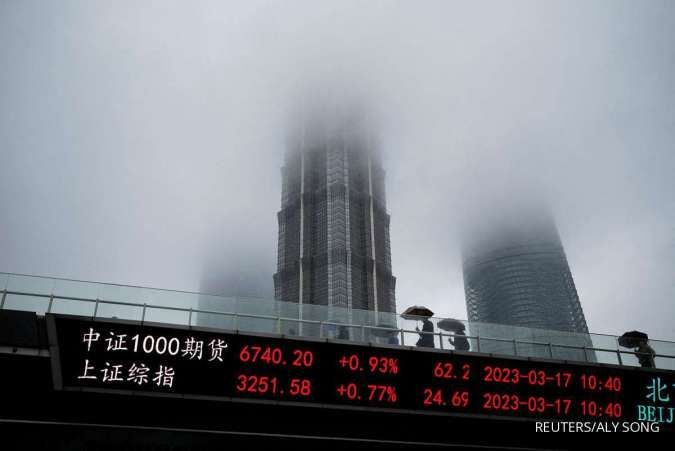

Earlier in Asia, regional shares slumped amid deepening worries about the Chinese real-estate sector after China Evergrande was ordered to be liquidated on Monday.

MSCI's all-country world index retreated when U.S. markets opened, down 0.07%, after earlier trading narrowly in positive territory at its highest since January 2022.

An unexpected rise in U.S. job openings in December and data that was revised higher for the prior month suggested the labor market likely remains too strong for the Federal Reserve - which starts its policy meeting on Tuesday - to start cutting interest rates as early as March.

Read Also: Cisadane Sawit Raya (CSRA) Records Palm Oil Production of 48,663 Tons in 2023

"The Fed is pretty much a non event," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York, referring to expectations the U.S. central bank will keep its target rate at 5.25%-5.50% when the meeting concludes on Wednesday.

"The real issue right now is earnings. We're in the heart of earning season and you've got big ones reporting after the close, Google and Microsoft," he said. "There's nervousness out there that one of these companies may miss and that may take down not only that company, but maybe some of the others."

The Dow Jones Industrial Average rose 0.05%, the S&P 500 lost 0.04% and the Nasdaq Composite dropped 0.37%. In Europe, the pan-regional STOXX 600 index rose 0.13% after earlier touching a fresh two-year high.

Bond investors weighed the unexpected strength in the U.S. jobs market with the Treasury Department's announcement on Monday that the U.S. government will not need to borrow as much as it had forecast in October.

Read Also: Analyst Recommendations: Marketing Sales of Bumi Serpong Damai (BSDE) Exceed Target

The yield on benchmark 10-year Treasury notes rebounded after the jobs data and then seesawed. It was last down 1 basis point at 4.082%.

Investors are keenly focused on the U.S. labor market as it is likely to signal when the Fed will begin cutting rates.

Germany's 10-year bond yield was up 1.3 basis points at 2.275%.

The dollar edged lower against the euro and higher against the yen, but failed to find strong direction ahead of conclusion of the Fed's policy meeting and Chair Jerome Powell's press conference.

The dollar index rose 0.058%, while the euro up 0.04% to $1.0837.

However, markets remained on edge as tensions in the Middle East kept Brent crude above $80 a barrel

Read Also: SMI Acquires 25% Shares of Waskita Toll Road, Accelerates Bocimi Toll Road Project

This week's other risk events for investors include the Bank of England's decisions on rates and U.S. employment data for January on Friday.

"Markets now have a sense of paralysis. They obviously want to see what the Fed is going to say this week ... and how much more is the door going to be opened to rate cuts," Marc Ostwald, chief global economist at ADM Investor Services, said.

Since the subprime crisis of 2007-2008, all rate-cutting cycles had been triggered by some form of financial instability, rather than an economic cycle, Ostwald said.

"We actually haven't had a normal rate-cutting cycle in response to a change in demand and changes in the labor market for a very long time, so that's why I partly think there is so much divergence in opinions," he said.

Markets expect a 45.6% chance of a Fed rate cut in March, according to CME Group's FedWatch Tool, down from an 88.5% probability at year-end 2023. They now anticipate 127.9 bps of cuts this year, compared with 160 bps of easing a month ago .

Read Also: Boosting Production PT Terang Dunia (United) Seeks Funding Through IPO

Oil prices rebounded from earlier losses that were kept in check by supply fears driven by escalating tensions in the Middle East.

U.S. crude rose 1.3% to $77.78 per barrel and Brent was at $82.96, up 0.68% on the day.

/2024/01/22/1341749805p.jpg)