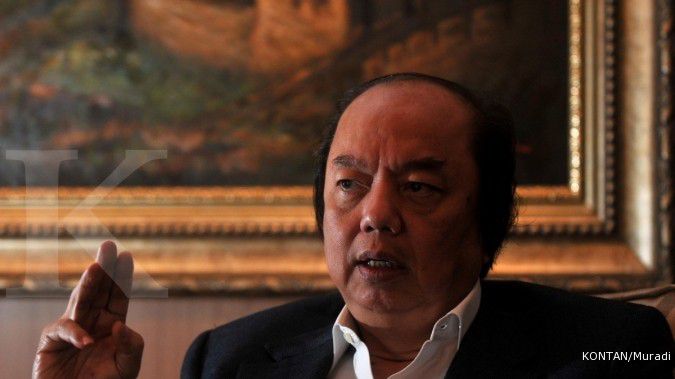

JAKARTA. When asked how far he wanted his business group to grow, Theodore Permadi Rachmat, 69, said that for his companies, there were no limits to growth.

Perhaps because of this philosophy, his business (which he established after he left his role as president director of Astra International in 2002) has kept growing. “Keeping high growth is important, but it should be sustainable,” said Indonesia’s ninth richest man, who is commonly addressed as Teddy, recently.

Teddy now has his own diversified business group called Triputra Group. The group, the holding company of which is called Triputra Investindo Arya, has 14 business units operating in various sectors, including oil palm and rubber plantations, coal mining, automotive dealerships and retailers, manufacturing, logistics and transportation services.

The biggest contributors to the group are companies in the commodity-based sector, particularly rubber processor Kirana Megatara, which — according to Triputra’s website — is now the largest crumb rubber processor.

Besides Kirana Megatara, another big contributor is oil palm planter Triputra Agro Persada, which claims to be the eighth largest palm oil producer with a 175,000 hectare area under cultivation. The company has a total of 388,000 hectares and expects to grow to 600,000 hectares by 2020.

Teddy, with a net worth of US$1.7 billion according to Forbes magazine, said it was now his intention to focus on commodity-based business.

“Thinking of what kind of business I was going to develop when I started Triputra [Group] 10 years ago, I chose a business that was not in competition with China but was a supplier to China. Therefore, I chose commodities,” Teddy said.

Creating a competitive advantage is one of his benchmarks for surviving in business. Teddy had a crucial role in Astra International, which was run by his mentor and uncle William Soeryadjaya, to switch its heavy equipment division in the early 1970s to the Japanese brand Komatsu, from the US-based Allis-Chalmers.

“Allis-Chalmers has a competitor, which is Caterpillar. They have the same qualities and the same price. Komatsu has the quality but is cheaper than Caterpillar,” Teddy said during a recent discussion at Atma Jaya University.

Astra International’s heavy equipment division has now transformed into the Jakarta-listed PT United Tractors, whose market capitalization reached Rp 68 trillion (US$7 billion) as of last Friday, dominating the heavy equipment industry in the country with a share of 43 percent as of the end of last February.

“Triputra is still small. Hopefully someday it can catch up with United Tractor,” Teddy told The Jakarta Post.

Teddy’s strategy for doing so might be different from his previous moves, particularly when he decided in 2004 to sell financing company Adira Finance to Bank Danamon.

“A financing company must have a bank behind it. I can’t compete on its own. Adira can’t be this big if it is not with Danamon. In plantations, we actually don’t need partners. The money and land are there. It just needs to be developed,” Teddy said.

The money raised from selling Adira was used to develop Triputra and its subsidiaries.

Kirana Megatara, whose factories are located in Sumatra and Kalimantan, obtained $600 million in syndicated loans from 12 banks in 2011. The money will be used to boost the company’s business. Teddy said Kirana’s production stood at around 500,000 tons per year but its installed capacity had now reached 1 million tons, thanks to expansion funded by the syndicated loans. The country’s rubber production reached 3.04 million tons last year.

Despite more independence in raising funds through loans, Teddy said he would maintain partnerships with his close friends.

“I have invited Astra to enter the Pako Group, which will increase its size, give it enough money for expansion and a guaranteed market,” Teddy said.

One of the units under Triputra, Pako Group, is focusing on steel and alloy wheel rims. Its production reached more than 5 million rims last year.

Besides Astra, Teddy has been linking up with individuals such as schoolmate Benny Subianto, cousin Edwin Soeryadjaya and son of Teddy Thohir (one of Astra’s founders), Garibaldi “Boy” Thohir.

Teddy has been partnering with Edwin, Benny, Boy and Sandiaga Uno in developing Adaro Energy, which now has become a top coal miner in the country.

“This is friendship. Moreover, we have similar ideas from Astra. We have the same teacher,” Teddy said.

Apart from palm oil producer Triputra Agro Persada, Teddy also has a stake in a joint venture with Benny and late friend Winarto Oetomo on a palm oil plantation, called Dharma Satya Nusantara, which is reported to be planning to hold an initial public offering (IPO) this year.

The plan, however, may be halted.

“The selling price [of crude palm oil] is declining. If we think we have good stuff why do we have to sell it too cheaply? The company is not in need of money. Whether the IPO will be this year or next year, we are still considering it,” Teddy said.

Taking a broader view of the country’s commodity sector, Teddy is expecting to see a comprehensive set of blueprints for the sector.

“We already have the infrastructure blueprint called the MP3EI. We have winning sectors, such as palm oil and rubber. What commodities will be the winners from Indonesia in the next 25 years must be planned from now. In palm oil for example, it is now 25 million tons, but how many tons do we want? Do we have enough area to reach 50 to 60 million? Without a blueprint we don’t know where to go,” Teddy said.

(Raras Cahyafitri/The Jakarta Post)