JAKARTA. The new government is expected to support the growth of property, while demand for residential properties continues to rise.

The success of Joko Widodo and Jusuf Kalla in winning the presidential race has been deemed instrumental in stimulating the property market in the second half of 2014, as many property developers and investors have left their wait-and-see mode in terms of investment.

The peaceful political process is also seen as positive and strengthens the confidence of the market in the future of the property sector in the country. Furthermore, active transactions were seen in the month of Ramadhan and Idul Fitri, another sign of optimism that the property market is bouncing back.

Property consultant and CEO of Leads Property Indonesia, Hendra Hartono, and chief marketing officer of Lippohomes, Jopy Rusli, expressed their confidence for the property sector for the third quarter this year.

According to Hendra, in general the property sector is bound to return to normal and would show positive growth. Retail and industrial subsectors are strengthening. The development of industrial zones, generally long-term investments, will follow the infrastructure development that the new government will be prioritizing.

The need for apartments in the suburbs has reached a level of real demand, as opposed to being just one instrument for investment some three to five years in advance.

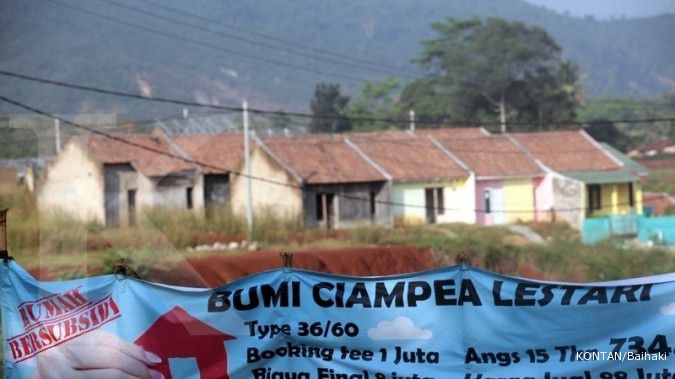

According to Jopy, the high need for residential properties is not only in first-tier cities, but also in suburban areas with limited space and high prices, as well as the need for connectivity in the form of transportation network and main infrastructure.

“Urbanites need comfortable residences, close to their places of work. And apartments are a major choice as they offer practicality, comfort and security,” Jopy said as quoted by kompas.com.

The limited availability of land and its soaring costs, heavy traffic and a growing population, as well as a high rate of urbanization, are some of the major factors behind the demand for apartments in suburban areas such as Serpong, Bintaro, Bekasi and Depok.

“The urgent need is related to city spatial planning, the requirement to develop green spaces and also the need for practical, comfortable and secure living,” Jopy asserted.

He added that the most popular suburban apartments were those that were integrated with other property projects – or so-called integrated developments. These came complete with shopping centers, health clinics or hospitals and other facilities, he said.

Meanwhile, research head at international property consultant agency Cushman & Wakefield, Arief Rahardjo, previously said that the presidential election in July had not had a significant impact on the condominium market in Greater Jakarta (Jakarta, Bogor, Depok and Bekasi – Jabodetabek).

According to Arief, this could be seen from the sales and pre-sales activities, which saw a slight increase in the second quarter.

He explained that mid-level condominiums still dominated the number of developed units and contributed around 52 percent of total sales. Segment-wise, Arief said that pre-sales of low level, mid-level, mid-to-high level and high-class condos had recorded sales of 63.8 percent, 67.5 percent, 57 percent, and 67 percent, respectively.

“More than 60 percent of people who buy condos purchase them as a means of investment; this indicates the strong sentiment for investing in property,” he explained.

Previously, Indonesia Property Watch reported that the property market had begun to show positive growth in Jabodetabek fringe areas.

“Despite the overall decline in the national property sector, analysis suggests that the property market is emerging in areas outside Greater Jakarta, and even outside Java,” said Indonesia Property Watch executive director Ali Tranghanda.

He said the price increases in Jabodetabek were around 15 to 20 percent, whereas the decline in sales reached an average of 49 percent.

“Developers in Jabodetabek have started to transform their businesses from landed residential to vertical residential properties, as we can see from the growing number of mid-level apartment projects and companies’ readiness to expand outside of Jabodetabek,” he said.

Ali revealed the potential for development in Sumatra, including Medan, Riau and Lampung, as well as parts of Kalimantan, and Central Java, and Manado. High growth has also been noticeable in Cikarang and Karawang in West Java; Malang and Surabaya in East Java; Makassar, South Sulawesi; Lampung province, and Balikpapan, East Kalimantan.

As for office space, Hendra said the sub-sector remained stable as businesses had for some time been planning their expansions. Those planning to relocate tended to opt for extending their leases for a few more years.

“The most important thing is that there are no riots on the streets. As long as the political and security situation remains stable, investors should keep coming. The same goes for foreign capital, as Indonesia remains one of the prime targets for investment in Asia’s property sector,” he said. (Gandi Faisal)

/2014/08/06/166467174.jpg)