JAKARTA. Indonesians must brace for an even weaker rupiah if Prabowo Subianto wins the presidential race, global investment bankers said.

A Prabowo victory in the presidential election on July 9 would trigger capital outflows, consequently pushing the rupiah rate further below 12,300 per US dollar, US-based investment bank Morgan Stanley wrote in a report released on Friday.

“Over concern that Prabowo may enforce nationalistic policies that may discourage foreign investments, the rupiah may weaken,” Morgan Stanley analysts, led by Geoffrey Kendrick, wrote in the report.

“A Prabowo victory would likely increase market volatility in the delicately poised macro environment,” he added

Further currency weakness may be problematic for the economy as the foreign exchange reserves held by Bank Indonesia (BI) “are not large enough to protect the rupiah in times of extreme stress”, according to the bank.

In contrast, the report said that a victory for frontrunner Joko “Jokowi” Widodo would strengthen the rupiah to 11,000 per dollar, in the event that the influential Golkar Party also switched sides and joined the government’s coalition camp.

Furthermore, a Jokowi presidency could encourage capital inflows, with Morgan Stanley predicting that the value of Indonesian equity assets would outperform emerging market peers by around 10 percent in the short term.

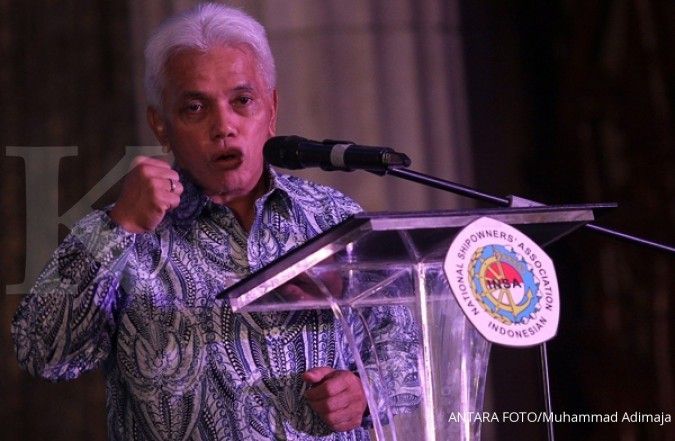

Prabowo, once a dark horse in the lead-up to this year’s election, has gained popularity recently as his strong oratory ability and nationalistic, pro-poor campaign promises have strong appeal among the public.

While Jokowi remains the candidate to beat, his lead against Prabowo — who is often branded as being anti-foreign investment — has narrowed from around 30 percent earlier this year, to a single digit recently, various pre-poll surveys have shown.

The tighter, neck-and-neck battle between the presidential contenders has prompted uncertainty in the market, creating jitters among investors.

The government’s 10-year bonds, the benchmark of a country’s borrowing cost, hit a five-month high at 8.3 percent this week. Meanwhile, the rupiah depreciated 1.1 percent this week to trade at 12,103 per US dollar, taking this quarter’s decline to 6.1 percent, according to the Jakarta Interbank Spot Dollar Rate (JISDOR).

The rupiah’s decline occurred amid the broad-based strengthening that other currencies are enjoying against the dollar. The Bloomberg-JPMorgan Asia Dollar Index, which tracks the region’s 10 most-active currencies excluding the Japanese yen, rose 0.2 percent this week and 0.6 percent this quarter.

“We think recent poll results showing Prabowo drawing close to Jokowi have been investor-unfriendly,” Tim Condon, an economist with Dutch-based investment bank ING Group, wrote in a report that analyzed the rupiah’s recent weakness.

For investors and analysts, there needs to be a “re-pricing” for the increased likelihood of a Prabowo victory due to the recent surge in his popularity, Condon said.

Prabowo was so disfavored by the market that 56 percent of investors questioned in a survey held recently by Deutsche Bank said that they would sell their Indonesian assets if he was elected president.

Meanwhile, in the same survey, only 6 percent said they would do the same if Jokowi was elected president. Expectations of Jokowi’s ability to implement reforms were so high that Barclays Bank predicted Indonesia’s credit rating could be upgraded to investment grade by Standard & Poor’s (S&P) financial services company before year end if he became president. (Satria Sambijantoro)

Prabowo victory bad for business: Global bankers

June 29, 2014, 10.28 AM

/2014/06/11/1818111976.jpg)

ILUSTRASI. Poster One Piece Live Action Netflix Terungkap! Ada Luffy dan Kru Bajak Laut Lainnya

Source: The Jakarta Post

| Editor: Hendra Gunawan

Latest News

-

March 02, 2026, 01.10 PM

Asian Assets Slide as Mideast Strikes Spark Oil Spike, Haven Rush

-

March 02, 2026, 10.49 AM

Bank Indonesia Monitoring Market Movements in Response to Conflict in Middle East

-

February 25, 2026, 08.28 PM

Inpex to Solicit Bids for Construction of Indonesia's Abadi LNG Project in Mid-2026

-

February 24, 2026, 03.38 PM

Eni to Reach Final Investment Decision for Indonesia Gas Projects Next Month

-

February 24, 2026, 01.00 PM

Asia Stocks Try to Steady after Wall Street Selloff Sims Mood

-

February 23, 2026, 04.50 PM

Wall Street Futures and Dollar Slide on Trump Tariff Tumult

-

February 23, 2026, 02.17 PM

Indonesia's Government Spending Jumps 26% in January 2026

-

February 23, 2026, 01.47 PM

Indonesia's Government Spending Jumps 26% in January

-

February 21, 2026, 06.00 AM

Indonesia's Pertamina to Maintain Bidding Process for US Energy Imports