BANK INDONESIA / BI - JAKARTA. Indonesia's central bank left interest rates unchanged for an eighth straight month on Thursday, as inflation has remained within its target range while it continues to stabilise the rupiah.

Bank Indonesia (BI) held the seven-day reverse repurchase rate IDCBRR=ECI steady at 5.75%, where it has been since January, as widely expected by 31 economists surveyed by Reuters. Its two other main rates were also kept unchanged.

The decision to hold rates was consistent with BI's stance to ensure inflation stays within the target range in 2023 and 2024, BI Governor Perry Warjiyo told a press conference.

The inflation target range will be lowered to 1.5% to 3.5% in 2024, the central bank said.

The rupiah remained emerging Asia's best performer but has gradually depreciated against the U.S. dollar in recent weeks to its weakest in six months, amid rising U.S. Treasury yields. Indonesian bond yields have also risen.

Read Also: Goldman Sachs Pushes Its Forecast for Fed Rate Cut to Q4 2024

BI has been trying to balance currency stability with keeping inflation in check while maintaining growth momentum in Southeast Asia's largest economy as exports fall amid softening commodity prices.

"Monetary policy remains focused on controlling the stability of the rupiah exchange rate as an anticipatory and mitigation measure against the spillover impact of global financial market uncertainty," Warjiyo told reporters.

BI expects the U.S. Federal Reserve to increase rates in November, which he said could maintain the dollar's strength. Meanwhile, a slowdown in major trading partner China could put pressure on Indonesian exports.

BI began offering its own notes this month in a tweak to its monetary operations, while also aiming to attract capital inflows. It sold $1.6 billion worth of notes in its maiden auction on Sept. 15.

Response from the market has been positive and BI recorded multiple oversubscriptions for its new securities in its two auctions so far, Warjiyo said.

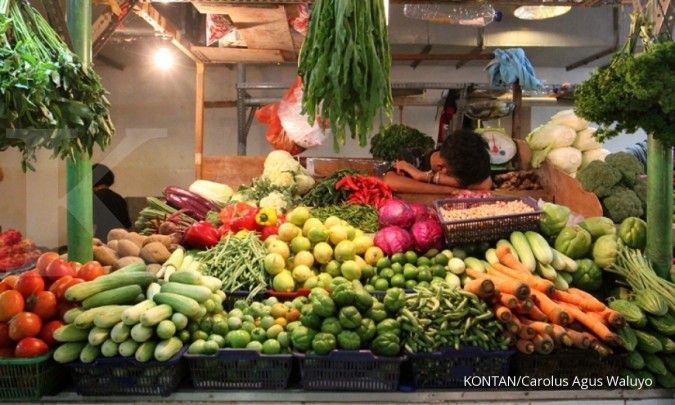

Inflation, which peaked near 6% last year on high energy and food prices, returned to BI's 2% to 4% target earlier than expected this year. In August, inflation remained close to the midpoint of the range at 3.27%.

/2023/07/13/2121840432.jpg)