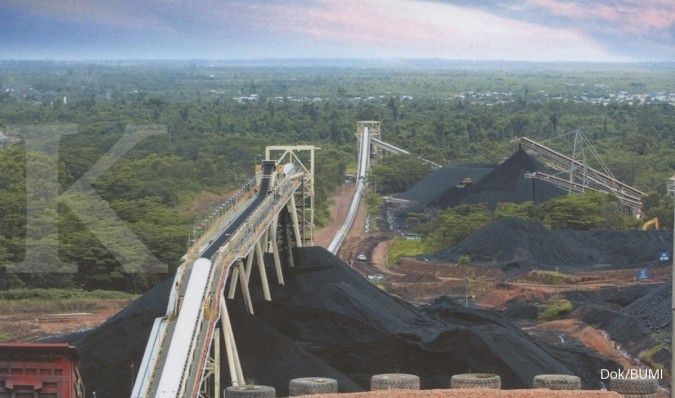

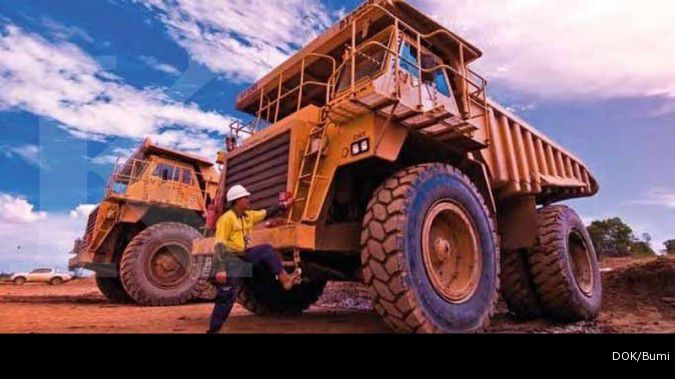

The country’s largest thermal coal miner, PT Bumi Resources, is set to swap its ownership in a number of subsidiaries and sell new shares to pay off its US$1.3 billion debt to its creditor, the China Investment Corporation (CIC).

Under the agreement, Bumi will swap 42 percent of ownership in its non-coal unit, PT Bumi Resources Minerals (BRMS), and 19 percent, respectively, in PT Kaltim Prima Coal (KPC), Indocoal Resources (Cayman) Ltd. and PT Indocoal Kaltim resources.

Bumi currently holds an 87 percent stake in BRMS, 65 percent in KPC and 70 percent stakes in both Indocoal Resources and Indocoal Kaltim.

Besides swapping the ownership stakes in its subsidiaries, Bumi will also issue new shares worth up to $150 million for ownership by the CIC in exchange for clearing its $1.3 billion debt, which will mature in 2014 and 2015.

Bumi did not specify how much of the amount would equal its enlarged capital.

The company’s director and corporate secretary, Dileep Srivastava, said Bumi would provide further information about the new share sale in the near future.

Shares in Bumi, which are traded on the Indonesia Stock Exchange (IDX) under the code BUMI, closed at Rp 485 on Wednesday, an increase of 6.59 percent compared to the day before.

Bumi’s announcement came after the stock market closed. Its market capitalization totaled Rp 9.5 trillion ($822 million) as of Wednesday.

The company said that if any residual amount emerged from the above measures, that amount would be converted into a three-year loan at a competitive market rate.

Srivastava reaffirmed that the precise details of any possible residual amount from the debt settlement would be disclosed later.

“Bumi will take steps to obtain the necessary approvals as per existing legislation and regulations, and will work to a final closure by year-end,” Bumi said in the written statement.

Bumi’s mounting debts have been a major concerns for investors.

Rating agencies, such as Moody’s Investors Service, downgraded the coal miner’s credit rating over concerns regarding its ability to pay the debt amid plunging coal prices and a prolonged dispute entangling the firm’s parent company, London-listed Bumi plc, which holds a 29.2 percent stake in the coal miner.

Bumi plc is in the process of divesting the subsidiary to Indonesian conglomerate, the Bakrie Group.

The CIC loan, which was divided into three tranches totaling $1.9 billion, was issued in 2009.

Bumi, the jewel in the crown of the Bakrie family’s business empire, used the funds to acquire stakes in mining contractor PT Darma Henwa, and coal miners PT Fajar Bumi Sakti and PT Pendopo Energi Batubara, as well as to pay off other debts and support expenditure. The company paid the first tranche of $600 million in 2011. (Raras Cahyafitri)

BUMI swaps stakes in subsidiaries to clear debt

October 10, 2013, 03.30 PM

/2013/09/19/2062230053p.jpg)

ILUSTRASI. BTN Syariah

Source: The Jakarta Post

| Editor:

Latest News

-

February 07, 2026, 05.13 PM

Indonesia-Australia Relations: Booming Business, Golden Opportunities for Investors

-

February 07, 2026, 04.59 PM

Indonesian Comedian Summoned by Police Over Netflix Show

-

February 07, 2026, 05.57 AM

GLOBAL MARKETS-Stocks, Bitcoin Rally, Regaining Some Lost Ground with Precious Metals

-

February 06, 2026, 07.58 AM

Indonesian Markets Face More Pressure after Moody's Cuts Outlook

-

February 05, 2026, 07.19 PM

Moody's Cuts Indonesia's Sovereign Rating Outlook to Negative

-

February 05, 2026, 02.43 PM

Indonesia Posts Fastest Economic Growth Rate in Three Years

-

February 04, 2026, 04.38 PM

Indonesia's Tax Revenues Jump in January, Finance Minister Says

-

February 04, 2026, 03.34 PM

AUD 1.6 Trillion Australian Pension Funds Ready to Pour into Indonesia

-

February 04, 2026, 02.13 PM

Indonesian Miners Halt Spot Coal Exports Over Proposal to Cut Output