JAKARTA. Publicly listed lender Bank International Indonesia (BII) and general insurer Asuransi Bintang will cooperate to provide the lender’s costumers with car insurance packages in a bancassurance arrangement.

The move aims to reap Rp 7.5 billion (US$623,000) in premiums annually, officials from both sides say.

BII card business head Laksono said at the launch of the cooperation on Thursday that the lender and the insurer would offer the insurance package to the lender’s credit card users via telemarketing.

“We want to offer our customers a variety of services. This will be the first time that we offer our customers this kind of insurance product,” Laksono said. The lender has about 1 million credit card users.

Asuransi Bintang president director Zafar Dinesh Idham said that the insurance arrangement would give BII credit card consumers with products that fall under its “varia” or miscellaneous insurance a maximum claim of up to Rp 30 million. The premium will be Rp 58,000 per month.

Varia cover includes stolen or damaged cars in the form of transportation fees and hospital fees for customers involved in car accidents.

The bancassurance cooperation is a part of the insurer’s target to boost its varia premium income by about 25 percent year-on-year to Rp 51 billion this year.

“We are seeking to boost growth of our varia insurance portfolio to help us enhance our business sustainability. Varia insurance offers a relatively low premium to a vast amount of consumers,” Zafar said.

“It guarantees a more stable income compared to other products with a higher premium, which is more likely to affect our performance with even a slightest drop in growth.”

The general insurer’s business portfolio last year was dominated by fire insurance, which contributed 43 percent to the insurer’s premium income, followed by varia insurance with 23 percent and vehicle insurance with 20 percent.

Jenry Cardo Manuring, finance and service director at the insurer, said it targeted to see its premium income “grow about 25 percent to hit more than Rp 300 billion this year”.

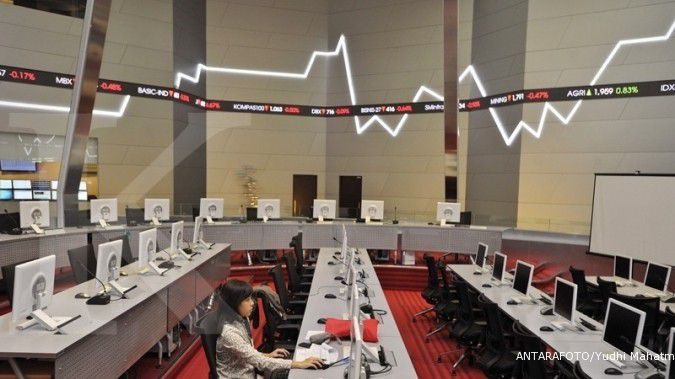

Asuransi Bintang has yet to publish its audited 2013 full year financial report. According to presentation material, posted on the Indonesia Stock Exchange (IDX) web portal in November, the company estimated its 2013 premium income would reach Rp 280.36 billion, or up by 17.17 percent compared to Rp 239.28 billion it booked in 2012.

The insurer recorded a modest net profit increase of 6.5 percent year-on-year to Rp 28 billion.

BII, part of Malaysia’s Maybank, reported that its bottom line was Rp 1.54 trillion in 2013, an increase of 28 percent year-on-year, as it was boosted by robust fee-related activities.

By December 2013, the lender’s net interest income climbed 9 percent to Rp 5.8 trillion and its fee-based income rose by 19 percent to Rp 2.29 trillion from a year ago.

BII’s financial report revealed that its outstanding loans reached Rp 102.03 trillion in 2013, 26 percent higher than 2012. For customer deposits, BII booked a 25 percent increase to Rp 107.24 trillion. BII has set both its loan and customer deposit growth targets at between 14 percent and 17 percent.

BII, Asuransi Bintang offer cardholder insurance

March 07, 2014, 11.26 AM

/2012/02/20/2144280233.jpg)

ILUSTRASI. Kebutuhan nutrisi kucing.

Source: The Jakarta Post

| Editor: Asnil Amri

Latest News

-

March 02, 2026, 04.45 PM

Indonesia has Seized 5 Million Hectares of Palm Oil Plantations, Task Force Says

-

March 02, 2026, 01.10 PM

Asian Assets Slide as Mideast Strikes Spark Oil Spike, Haven Rush

-

March 02, 2026, 10.49 AM

Bank Indonesia Monitoring Market Movements in Response to Conflict in Middle East

-

February 25, 2026, 08.28 PM

Inpex to Solicit Bids for Construction of Indonesia's Abadi LNG Project in Mid-2026

-

February 24, 2026, 03.38 PM

Eni to Reach Final Investment Decision for Indonesia Gas Projects Next Month

-

February 24, 2026, 01.00 PM

Asia Stocks Try to Steady after Wall Street Selloff Sims Mood

-

February 23, 2026, 04.50 PM

Wall Street Futures and Dollar Slide on Trump Tariff Tumult

-

February 23, 2026, 02.17 PM

Indonesia's Government Spending Jumps 26% in January 2026

-

February 23, 2026, 01.47 PM

Indonesia's Government Spending Jumps 26% in January