JAKARTA. Some of the country’s big lenders are confident their overall credit portfolio will still see steady growth despite a slowdown in mortgage loans, following the issuance of a Bank Indonesia (BI) regulation on landed properties and apartments in September.

PT Bank CIMB Niaga head of consumer lending Tony Tardjo said he was optimistic that the bank would be able to maintain the quality of its mortgage credit portfolio, increase growth and reduce the number of non-performing loans.

As of September, CIMB Niaga’s non-performing mortgages were below 2 percent, decreasing from 2.19 percent in the third quarter of 2012.

Tony said that the new BI regulation, which would reduce the loan-to-value (LTV) ratio for the purchase of a second property, would slow down the market of loans for housing but not for another six to 12 months.

“This will impact the purchasing power of the people but not the bank’s overall growth,” he said.

As of June this year, CIMB Niaga had channeled Rp 23.5 trillion (US$ 2.06 billion) in mortgage loans.

The figure marked a 13 percent increase from the same period last year, which was Rp 20.4 trillion.

Tony said that CIMB Niaga planned to raise the mortgage loans by around 11 percent as of December this year.

“Looking at the current situation, we don’t want to set a higher target,” he said.

PT Bank Central Asia Tbk (BCA) consumer credit director Henry Koenafi predicted that the lender’s mortgage loans would decline to 30 percent this year compared to 2012.

As of June 2013, BCA had channeled mortgage loans worth a total Rp 42.3 trillion, which is an increase from Rp 36.5 trillion in June 2012.

“The regulation caused slower credit portfolio growth this year. However, the impact will only happen in the short term,” he said.

He added that the new central bank regulation would muffle speculation, which in turn would lead to a healthier lending environment.

Meanwhile, state-owned Bank Tabungan Negara (BTN) finance and treasury director Saut Pardede said on Friday that the new regulation had little impact on the bank’s credit portfolio.

“Around 98 percent of our mortgage customers use credit to buy their first house,” he said, adding that the bank’s portfolio was also in rupiah and would not be affected by fluctuation.

He said that BTN had channeled credit totaling Rp 92 trillion as of September this year.

Forty-six percent out of that number, or Rp 42 trillion, was mortgage loans. The figure, he added, was up 22 percent from the third quarter of 2012.

BTN’s director Maryono said the company planned to increase the number of mortgage customers by improving services.

Meanwhile, CIMB Niaga chief economist Winang Budoyo said that banks were among the healthiest sectors as they were under the strict supervision of BI.

“BI learned from the 1998 economic crisis and issued strict regulations on property loans,” he said.

He added that the LTV regulation would prevent private and state-owned lenders from collapsing due to the property bubble.

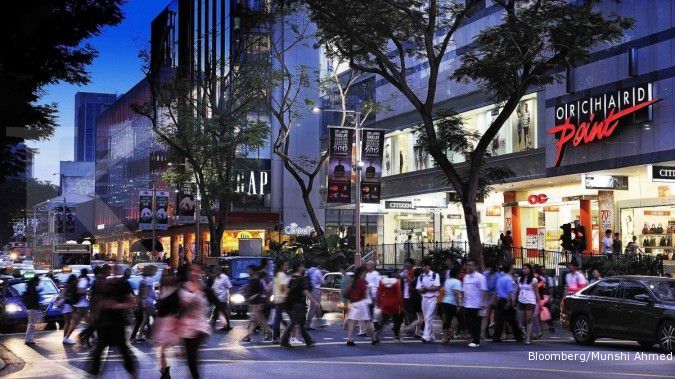

Winang added that Singapore had taken steps to reduce the LTV ratio for property loans. (tam)

Internasional

/2013/09/10/1654275672.jpg)