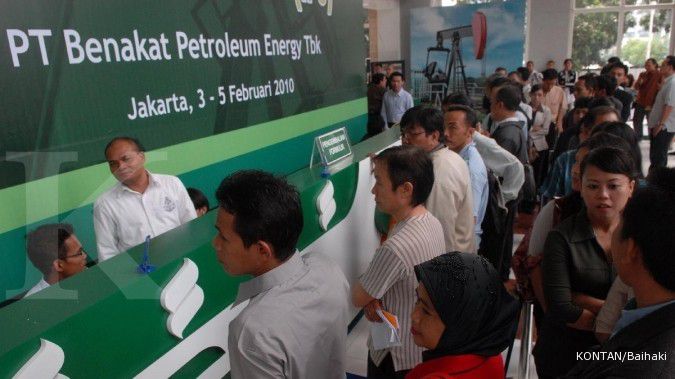

Listed PT Benakat Petroleum Energy is planning to sell its manganese-producing subsidiary, as part of the integrated energy company’s effort to pay loans for its recent acquisition of a mining infrastructure firm.

Benakat says it will also welcome companies to partner with its subsidiary PT Nusa Energy Raya in the construction of smelters, an executive says.

“If anyone wants [to buy the manganese subsidiary], go ahead. Or, perhaps, they want to cooperate with us [to build smelters] because manganese mining will need smelters, we will welcome them,” Benakat president director Suluhuddin Noor said.

Noor was referring to stipulation in the mining law that bans the export of unprocessed mineral ores starting in January 2014.

The stipulation has pushed miners to build smelters themselves or in cooperation with other companies.

Benakat holds 79.97 percent stake in PT Nusa Energy Raya, which holds license for manganese production on 1,015 hectares of land in East Nusa Tenggara.

At present, Nusa Energy is still in construction and has yet to begin its production stage.

According to Benakat’s first quarter financial report, Nusa Energy’s total asset is worth Rp 7.38 billion.

In addition, Benakat announced last week that its 99.96 percent subsidiary PT Benakat Mining entered an agreement to sell its 27.43 percent stake in coal miner PT Java Mitra Sentosa to PT Aiwa Artha Sejahtera for Rp 412 billion.

Corporate secretary Dina Andini Rohali said funds raised from selling the coal asset were used to pay part of loans to Poseidon Corporate Services Ltd which lent the company US$220 million for the $6000 acquisition of mining infrastructure provider PT Astrindo Mahakarya Indonesia.

Prior to selling Java Mitra Sentosa, Benakat also sold its 99.8 percent stake in energy services provider PT Benakat Patina for $105 million.

The fund raised from selling stakes at Benakat Patina was used to support the acquisition of Astrindo.

Following the acquisition, which was delayed for one year but had been completed in June, Astrindo is expected to be the main contributor to Benakat.

Finance director Michael Wong has said that Benakat would likely report a jump in its top line and bottom line by the year end, thanks to consolidation of Astrindo into the company’s financial report.

Benakat is estimating its revenue would touch Rp 2.2 trillion this year, a massive jump from only Rp 357 billion in 2012.

Net profit is expected to stand at Rp 720 billion this year, surging from Rp 8.67 billion in 2012.

The company reaped Rp 77.76 billion in revenue in the first half of the year, declining by around 19 percent from Rp 96.27 billion in the same period last year. Its net profit was Rp 3.08 billion, a steep drop from Rp 9.32 billion.

Noor said the company had no further acquisition plan in the pipeline and would focus on Astrindo’s operation and seize any opportunity to cut the debt level.

“I see the potential for development in the conveyor business for coal transportation because there are a number of miners that cannot deliver by train or trucks,” Noor said.

“However, I don’t have the plan yet. For now, we need to take a breath after the acquisition of Astrindo.”

Shares in Benakat, whose shares are traded on the IDX under a code BIPI, were closed at Rp 130 apiece on Tuesday, increasing by 0.77 percent from Rp 129 a day earlier. (Raras Cahya Fitri)

Benakat to sell manganese subsidiary

July 24, 2013, 12.26 PM

/2011/12/01/322230443.jpg)

ILUSTRASI. Mulai 26 Februari 2022 pukul 24.00 WIB, tarif Tol Dalam Kota akan mengalami kenaikan. ANTARA FOTO/ Fakhri Hermansyah

Source: The Jakarta Post

| Editor:

Latest News

-

February 24, 2026, 03.38 PM

Eni to Reach Final Investment Decision for Indonesia Gas Projects Next Month

-

February 24, 2026, 01.00 PM

Asia Stocks Try to Steady after Wall Street Selloff Sims Mood

-

February 23, 2026, 04.50 PM

Wall Street Futures and Dollar Slide on Trump Tariff Tumult

-

February 23, 2026, 02.17 PM

Indonesia's Government Spending Jumps 26% in January 2026

-

February 23, 2026, 01.47 PM

Indonesia's Government Spending Jumps 26% in January

-

February 21, 2026, 06.00 AM

Indonesia's Pertamina to Maintain Bidding Process for US Energy Imports

-

February 20, 2026, 01.23 PM

Indonesia Secures 19% Tariff Deal with US, Palm Oil and Other Commodities Exempt

-

February 20, 2026, 08.33 AM

Indonesia, US Sign Agreement on Reciprocal Trade, Indonesian Ministry Says

-

February 19, 2026, 08.12 AM

Indonesia, Freeport Units Sign MoU to Extend Mining Permit beyond 2041