JAKARTA. The plan to impose progressive tax on land ownership, capital gain on land transactions, and unutilized tax in idle land has sparked pro and contra. Aside of the land lords and the entrepreneurs, Directorate General of Taxation is also unsure about the plan.

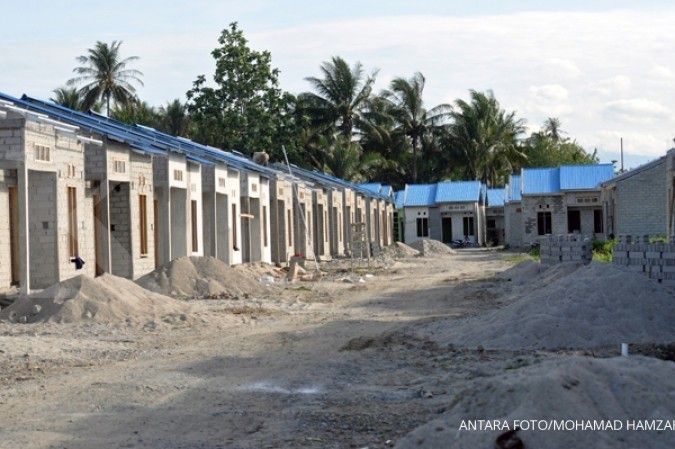

Chairman of Indonesian Real Estat Brokers Association (AREBI) Ronny Wuisan said, the policies will be facing major challenges at the implementation level, as the lands have the equal price. Therefore, a close cooperation with the local governments is necessary to ensure that the policy will be implemented properly.

According to Ronny, the regulation will be misdirected if it is only targeting the property developers, on the grounds that many developers do not have significant numbers of landbank. Therefore, the policy also needs to target the individual land owners, such as the local entrepreneurs, he said.

Ronny also perceives that the regulation will be a burdensome for the owners of disputed lands or inherited lands, since many of them own the lands not for business or housing purposes. Therefore, the policy may encourage the land owners to sell the land, instead of paying tax in every year.

Needs further assessment

However, the policy will mostly affect to the industrial zone entrepreneurs, who have the ownership over hundreds hectare of land plots. Ronny implied that the entrepreneurs will be facing the dilemma of the regulation.

On one hand, the entrepreneurs are unlikely to build properties on the land merely to avoid the progressive tax. But on the other hand, the entrepreneurs would be difficult to determine the price, if they build the properties on the land.

Meanwhile, the Directorate General of Taxation suggests conducting further reviews on the mechanisms of progressive tax, capital gain tax, and unutilized asset tax. The Directorate General of Taxation expects that the regulation would be misdirected.

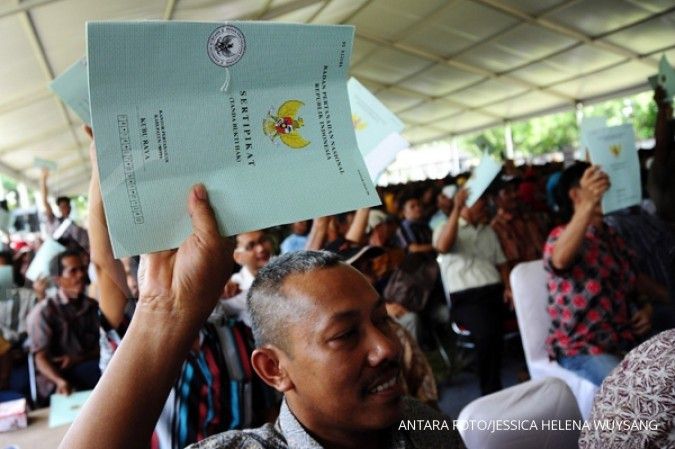

Director of Counseling, Services, and Public Relations of Directorate General of Taxation Hestu Yoga Saksama said, the implementation of capital gain tax requires a legal product at the level of law, which has to be discussed with the DPR (the House of the Representatives).

Hestu admitted that the tax authority has to be careful in determining the mechanism in implementing the tax on the idle land. In this case, the Directorate General of Taxation admitted that the progressive tax would be hard to implement, on the grounds that the government needs to have clear definition and target about the idle land. Therefore, he called public not to be anxious of the regulation.

“This aims at preventing idle lands and land speculation,” he said.

Member of Commission XI of DPR Misbakhun also said that DPR has not yet planned to discuss about the imposement of the taxes. According to him, the arrangement of taxation policy requires a law, which should be discussed with the DPR. “Any tax collection should be regulated by law. That is the mandate of constitution,” he said.

(Muhammad Farid/Translator)